It entails extra calculations and separates expenses into classes, however the profit is a clearer view of your company’s overall profitability. Profitability ratios help assess how effectively a enterprise is turning revenue into profit. In different words, they measure how a lot a enterprise earns relative to its bills. Profitability ratios are helpful for understanding monetary well being over time, or evaluating efficiency with different companies. Customizing your QuickBooks P&L report to emphasize the information most relevant to your small business goals may help you focus on what issues. Tailor the columns to reflect your particular revenue streams, expense categories, and revenue facilities.

Obtain The Free Revenue Assertion Template

The profit and loss assertion is important as a outcome of it tells you if your corporation is popping a profit. We work with native companies providing bookkeeping companies in Roseville, Rocklin and the Higher Sacramento Area. Reach out today to discover how Bandwidth Bookkeeping Companies might help you tailor your monetary strategies and drive sustainable enterprise progress.

Use Your Profit And Loss Statement To Grow Your Corporation

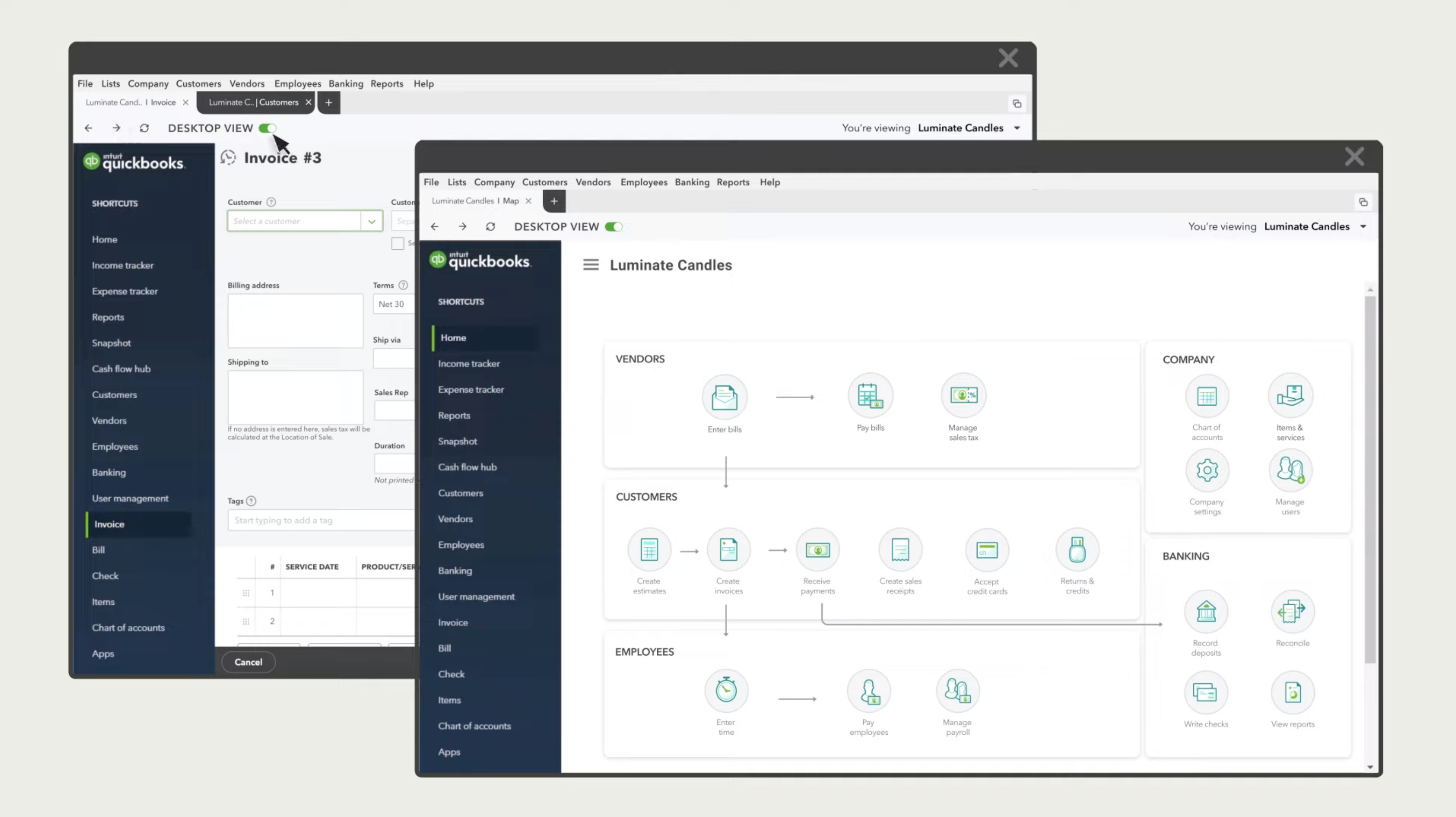

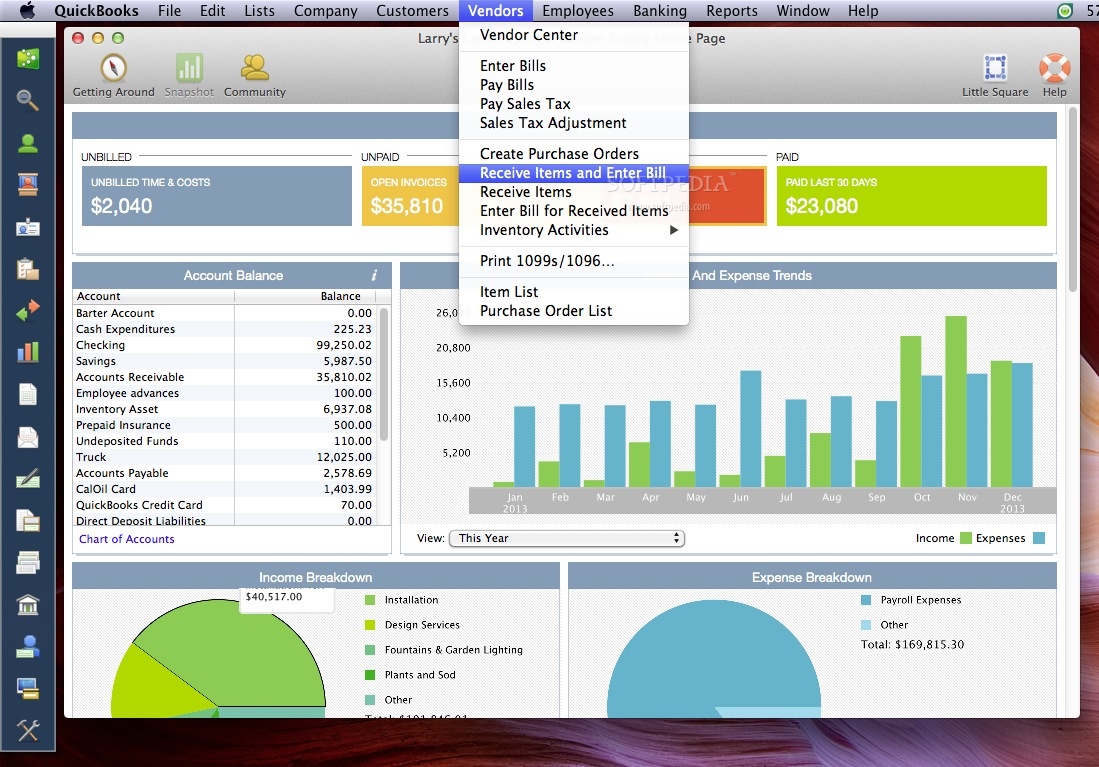

You’ll see a listing of options on the highest of the Profit and Loss Reports page. Click on ‘Dates’, and select a Date Range as proven in the picture below. The Date Range is the length of time you want the report again to cover.

This will allow you to see where your business stands all year long so you presumably can modify your methods as wanted. After you have completed establishing the P&L assertion in QuickBooks, use the report by printing, emailing, or downloading it. You also can view the P&L status in QuickBooks in chart view through insights.

This is the best report for understanding whether your corporation is profitable or losing cash. The 5 parts of the revenue assertion are sales (or revenue), value of goods offered, gross revenue, working expenses, and internet revenue or loss. Many small businesses select to create revenue statements on a monthly basis to find patterns in earnings and expenditures. Understanding the monetary health of your small business is essential for making informed selections and planning for the lengthy run.

Each business is different, so you have the power to customise your stories to see the information that issues whereas accessing insightful business analytics. Part of monitoring the value of items bought (COGS) is making sure that every cost is accounted for and precisely inputted into your financials. To accomplish that, you possibly can utilize the various choices obtainable by way of Quickbooks Online. Half of standard bookkeeping is making sure that all bills related to your corporation are precisely recorded. There are several options that can assist you with recording and categorizing all your bills. Quickbooks On-line offers a variety of choices for recording revenues, including invoicing and exporting financial institution info into your account.

Many business homeowners marvel if they need to produce money or accrual foundation earnings statements. For tax purposes, most small companies have to create cash-basis income statements. A cash-basis statement shows your income as it’s obtained and your bills as they’re paid. If you’re creating your QuickBooks revenue assertion for tax- or loan-application purposes, ask your tax advisor or business mortgage officer which basis they need. QuickBooks revenue and loss statement exhibits a summarized account of the entire earnings and expenses of the enterprise at a specific time. With this report, customers can manage their monetary conditions fairly properly.

Bookkeepers and accountants can help https://www.quickbooks-payroll.org/ you uncover hidden insights, recommend finest practices for managing your financials, and tailor strategies for progress. Collaborating with a monetary skilled ensures you are leveraging your QuickBooks P&L information to its full potential. The Profit and Loss Reports web page has a variety of options on the high.

- If so, that can be the reason why some of the stories usually are not showing even if you’re not using the Simple Start plan.

- A Profit and Loss (P&L) statement is an important monetary doc for companies, offering insights into revenue, expenses, and profitability over a particular period.

- The web earnings will either be a profit or a loss—or, in very uncommon cases, zero.

- Plus, if there are particular sections you need to spotlight, sharpen these before printing.

- Choose the format you want, and QuickBooks will routinely produce the report for you.

For instance, supplies utilized in a certain task deduct out of your internet revenue even when you haven’t paid for them yet. Comparing revenue and prices this way is way more accurate than looking at cash move. Using the info sync, your bank and credit score statements may be aligned so transactions are inputted into your monetary database either monthly or as they occur. You can also connect some other sales accounts, which embody Square and Paypal. Any transactions not lined in the information sync should be manually inputted by your bookkeeper into the system.

Comparing P&l Statements

Customization would not just reflect your small business but additionally your specific questions and priorities. Study how to run a profit and loss statement in Quickbooks with our comprehensive guide. Here’s the means to use QuickBooks Online to create an revenue assertion — as properly as QuickBooks Desktop — plus, every little thing else you’ll must become an professional at this totally important function. Billie Anne is a freelance author who has additionally been a bookkeeper since before the turn of the century. She is a QuickBooks Online ProAdvisor, LivePlan Professional Advisor, FreshBooks Licensed Companion and a Mastery Level Licensed Revenue First Professional. She is also a information for the Revenue First Professionals organization.

I suppose since Intuit is conscious of about this now they will cripple it. Detail P&L is completely essential for tax preparation and defense of revenue and deductions. You also can verify about creating customized stories in QuickBooks Online quickbooks profit and loss statement Advanced on your extra reference. Let me know in case you have extra query about running reviews. This possibility is out there if you proceed to print, guaranteeing you might have each a digital and physical copy on your data. Alignment issues can typically be fastened by adjusting the print format settings similar to orientation and margins in the print setup web page in QuickBooks.